Annual Returns

FAQ

What is an annual return?

In order to keep your company active, The Company Intellectual Property Commission (CIPC) requires that you disclose your total income to them for the particular year in question.

CIPC then calculates a fee based on this income, called an annual duty.

When must I complete the annual return?

The annual return is due every year.

It must be completed and paid before the end of the following month after the registration date of your company.

As example:

Company was registered on 10 May 2019 - the annual return is due before the end of June each year.

What will happen if I don't submit the annual return?

CIPC will assume that your company is dormant (not trading)

They will then start the process to deregister your company.

You will be liable for late penalty fees.

What is the cost?

The annual return cost: R550

This excludes the annual duty fee payable to CIPC

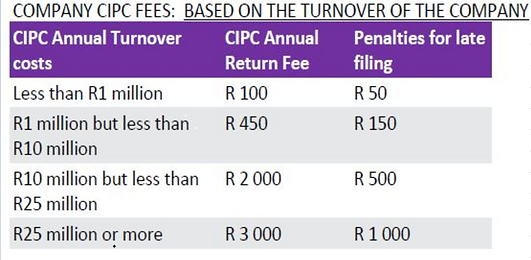

How does CIPC calculate the annual duty payable to them?

What is CIPC banking details?